Black Fox Real Estate recently had the pleasure of sitting with David Coloretti from Resolve Finance Mornington Peninsula to highlight the path of interest rates, implied by the RBA and financial markets, and explain how property buyers’ borrowing capacity will be impacted.

The RBA have raised their cash rate for the first time in almost 12 years. They have been clear in their intention to implement a series of cash rate rises and financial markets now imply that these rises will be material in the coming 2 years. Banks were quick to pass on the full 0.25% in their variable mortgage rates, which means increased cost of mortgages and reduced borrowing capacity for borrower. When there’s so much noise in the market, it’s important to know the facts and arm yourself with information about your unique situation, so you can take charge and plan for your personal circumstances.

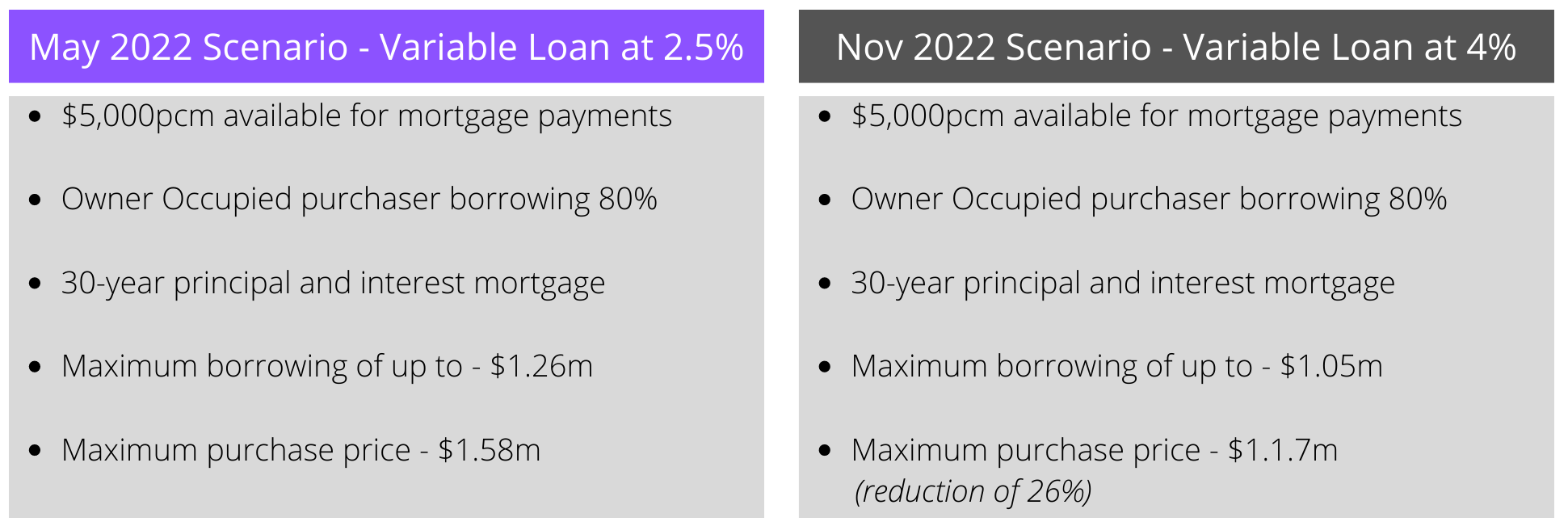

IMPLIED IMPACT ON PROPERTY BUYERS – MAY Vs NOV 2022

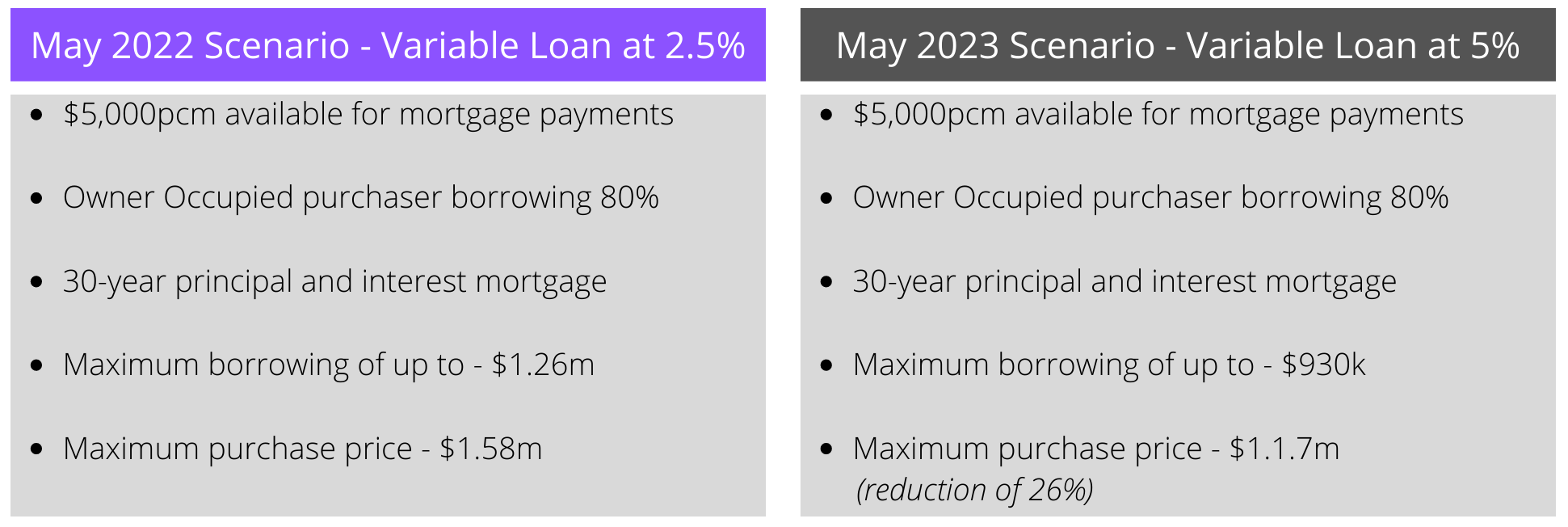

IMPLIED IMPACT ON PROPERTY BUYERS – 2022 Vs 2023

The above scenarios include conservative estimates of the increase in variable home loan interest rates of 1.5% and 2.5% in the coming 6 months and 1 year. These increases are based on forward RBA cash rate estimates published on 16 May 2022 on Bloomberg page MIPR (Market Implied Policy Rates). The exact increases in the RBA cash rate, implied by financial markets on Bloomberg, are 2.06% and 3.05% in 6 months and 1 year. These implied rates are based on current information that is subject to change. There is no certainty in these estimates and we cannot predict how lenders will pass on these increases to consumers.

Based on implied RBA cash rates, a property buyer with a 20% deposit and stable income over the next year may see his/her target property price point diminish by 17% in 6 months and 26% in 1 year. Therefore – Buyers who do not BUY NOW may risk BUYING LESS in the future.

Strategies to help you tackle changing markets and interest rates

Financial markets are predicting more rate rises to come, so now is a great time to think about how you’ll manage this change over time. It’s important to remember that there is no crystal ball when it comes to interest rate changes. Being prepared for a variety of outcomes is critical. Understand the potential scope of change and plan for the best and worst case scenarios.

The key to any market change is understanding exactly what it could mean for you and staying focused on your personal finance goals. Try to avoid the media headlines.

Understand your personal situation – don’t get caught up in the headlines

It’s so easy to get caught up in dramatic media headlines about interest rate changes and what they could mean for property buyers and homeowners. Try not to get distracted by this kind of noise and take control of your personal situation.

The next step:

We highly recommend speaking with David – David has a wealth of knowledge with some 30 years of banking experience – take advantage now and contact David to discuss your Financial/Mortgage needs.

Information contained in this presentation should not be deemed as finance advice and is based on information from external sources. Finance solutions provided by Resolve Financial Solutions Pty Ltd trading as Resolve Finance| ACN 079 545 378 | Australian Credit License 385487 | Individual Authorised Representative No. 534394